By Lulu Yilun ChenJune 9, 2020, 5:00 AM GMT+8 Updated on

Hong Kong exchange’s race to attract big Chinese technology listings comes with one big risk, say money managers: The city’s ability to keep the investing dollars flowing in as it’s roiled by political tensions.

Hong Kong Exchanges & Clearing Ltd. has been pulling out all the stops to attract China’s brightest stars as questions mount about their U.S. listings. Approvals for JD.com Inc. and NetEase Inc. were greenlit in a matter of weeks due to rule changes and the fact that they already had listings. Approvals for initial public offerings typically take months.

The bourse is also pushing to cut the settlement time for listings to boost liquidity, an issue that has dogged multi-billion-dollar deals in the past, causing dislocations to interest rates and the currency. Some investors now fear a flood in issuance will be hard to absorb and be left with little support, especially at a time when the international investor base the city needs is becoming increasingly worried about U.S. retaliation after Beijing proposed a controversial new security law for Hong Kong.

“If the U.S. creates measures barring U.S. funds from investing in Chinese company IPOs, or listings in Hong Kong, that could really hurt liquidity,” said Louis Tse, Hong Kong-based managing director of VC Asset Management Ltd. There is already concern, he said, about the impact of the proposed security law on international investors.

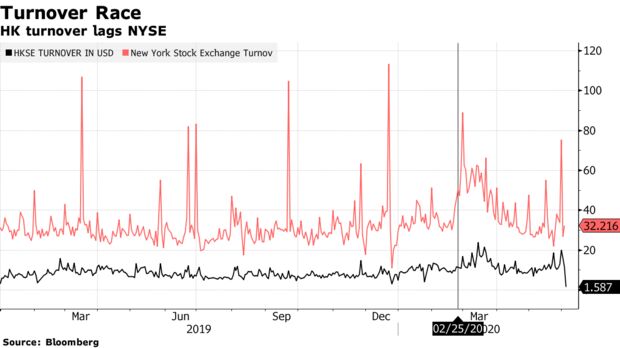

While Hong Kong led the world in listings last year, turnover on the exchange is just about a quarter of the dollar value relative to U.S. peers. Alibaba Group Holding Inc. has drawn just a fraction of activity in Hong Kong compared with New York after last year’s $13 billion secondary listing, partly due to a local stamp duty which curbs high frequency trading. Alibaba is not part of the link through which Chinese mainland investors can place money in Hong Kong, a decision that’s being held up in Beijing.

The recent legislative push from Beijing has reignited large pro-democracy protests in Hong Kong and fanned tensions with the U.S. Trump has threatened to revoke Hong Kong’s special trading status, which could potentially include the right to freely trade the dollar to which its domestic currency is pegged.

“There’s concern that from the U.S.’s perspective they could view Hong Kong as a loophole for China to tap international capital,” Michael Joseph, co-CEO of Ion Pacific, a venture capital fund that operates in Hong Kong and the U.S. “If the U.S. really wanted to take a hard stance on China, they could plug the gap, which could spell trouble for Hong Kong.”

The upshot is that Hong Kong may end up with big names that attract but a modicum of investor interest — a situation that can only threaten its ambitions to catch up with London and New York.

Deep, Liquid

The exchange emphasized that its move in 2018 to allow weighted voting right companies such as Alibaba, Xiaomi Corp. and Meituan Dianping to list has been a success, with their daily turnover now accounting for 11% of the total. Stock trading on the bourse has jumped 33% this year, hitting HK$116 billion a day, in part due to volatility during the coronavirus pandemic. It recently announced a license agreement with MSCI Inc. to introduce a suite of futures and options contracts.

“Hong Kong’s international financial markets are broad, deep, liquid and resilient,” HKEX said in a statement to Bloomberg. Its share price rose 0.2% as of 11:27 a.m. in Hong Kong trading.

NetEase last week raised $2.7 billion in its listing, while China’s No. 2 online retailer JD is seeking to raise as much as $4.1 billion in a deal that is multiple times oversubscribed by institutional investors, people familiar with the matter said.

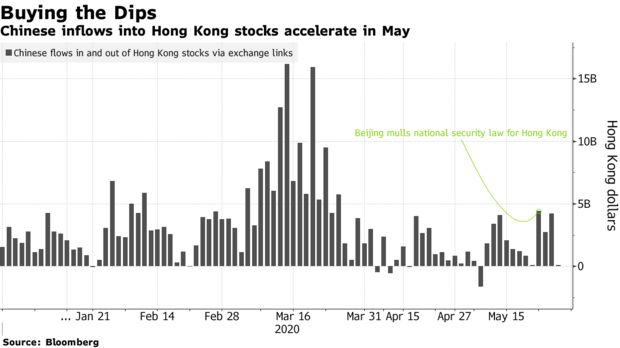

A welcome source of liquidity amid the turmoil is coming from China. Mainland money is flowing into Hong Kong at an unprecedented pace this year, primarily supporting Chinese state-owned firms. Mainland investors own about 2.9% of the stocks eligible for cross-border trading, the highest since data became available in March 2017, according to Bloomberg calculations.

But that flow is still far from the quota limit of 84 billion yuan a day. Opening the link to the likes of Alibaba could go a long way in boosting inflows further.

The rush to list comes as a proposed bill in the U.S. Senate could force Chinese tech companies to stop trading in New York by imposing greater accounting disclosure requirements, a move that’s opposed by Beijing. Nasdaq Inc. has also tightened its rules for listings, primarily aimed at Chinese companies.

How China Stars May Be Forced From U.S.

The Hong Kong bourse has also conducted a consultation on whether to allow corporate entities to hold weighted voting rights, which if passed might lure more of the portfolio companies backed by large corporates such as Alibaba and Tencent Holdings Ltd., according to Michael Yu, a partner at Cooley in Hong Kong.

“The Hong Kong exchange is trying to reform its regulatory framework in ways more similar to its U.S. peers, by giving issuers and investors more flexibility,” he said.

The bourse’s plan to reduce the settlement time in IPOs from the current five days also won’t likely be implemented until toward the end of the year at the earliest, Bloomberg reported earlier.

But the actual cost of trading has also hampered activity.

The bourse two years ago flagged it was evaluating rebates for market makers, easing collateral rules across multiple positions and removing or reducing the stamp duty. Little of that has materialized.

At the end of the day, not all companies will attract the same amount of interest as Alibaba, especially if secondary listings continue to build. Yum China Holdings Inc. is preparing for one and Baidu Inc. and Trip.com Group Ltd. are also reported to be weighing the option.

“If these Chinese tech companies were to be looking to issue new shares in Hong Kong, there might not be sufficient demand for all of them,” Joel Chu, a former trader and founder of Executium, a fintech company servicing traditional and crypto traders.

— With assistance by Kiuyan Wong

This article was also published in Bloomberg